It was also not avoided the reconsideration of such hot-topics, reflected through this new light, such as, the role of religion, financial markets, SAFE harbours of the financial world of bonds issued by the states in a globalised world, long before the crash of financial markets (2008), when NOBODY ELSE DARED IN A SO PLAIN WAY, but simultaneously FOUNDED ON A SO SOLID METHODOLOGICAL background, to criticize this kind of ideological absolute dogmas, embodied within the latest established financial, economic and cultural order, termed DEBTISM by this creator of knowledge. In short, debtism is based on the economy of debtors, a growing spiral of continual borrowing, that is, further run in this debt way. In other words, this type of economy functions only through further indebting [borrowing: by increasing debts at the GLOBAL, STATE'S, group's, individual level]. Within this latest established natiocratic economic and financial order, as a result of shift of the main motivator for doing business and driver of economy:

- - the leading role of financial corporations and (inter national) financial institutions;

- the (RE)selling shares (and the financial corporations as well) DIA the increasing its "value" by increasing the PRICE of share on the financial market is the point of running a business, thereby paying not too much attention what are the long-term consequences of this;

- pay ALSO attention to the fact that these financial transactions of reselling existing (issued) shares ["THE HISTORICAL CASH DIA INVESTED CAPITAL", seen from the perspective of a financial corporation] and the related cash flows occur OUTSIDE of financial corporations: ON GLOBAL FINANCIAL MARKETS, that is, these EXTERNAL cash flows have no DIRECT relation with the INNER cash-flow of financial corporations;

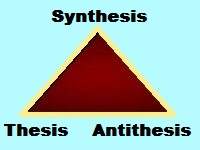

- in short, by using this developed methodological (DIALECTICAL) approach, there were unmasked DIA again separated the ideologically interweaved (and then CROWDED) internal cash flows (THESIS), collected for the newly issued shares (useful for the financial corporation), from the external cash flows (ANTITHESIS), collected by their (TEMPORAL?) owners by RESELLING existing issued shares [unsignificant for (the cash flows of) the financial corporation];

- recall, only these internal cash flows determine the present (true) VALUE of share DIA THE PAID OUT DIVIDENDS from the ACHIEVED PROFIT to its (TRUE) SHAREHOLDERS - OWNERS (SYNTHESIS DIA THE RENEWED THESIS), and not these external ones, that is, the current "value" (PRICE) of share determined by the financial market, that over the passage of time DIA space leads to the formation of a gap between these two contradictory divergent approaches of evaluating (value versus price) of shares (financial speculative bubbles) during the process of managing these short-term goals and long-run objectives;

- because of the fact the all key-actors are changeable over (long) time DIA space, beginning from owners (of shares) to the members of top-management and board of directors, it is to be expected that short-term incentives will be the preferred choice;

- replacing another fundamental postulate of finance, "CASH IS KING", that is, CASH FLOWS WITHIN the financial corporation with an appropriate postulate of the so-called debtor's DIA debt economy, "DEBT, IT IS THE NEW KING FROM NOW", finally, a new economic, financial, and cultural natiocratic (societal) system has been established in the full sense of the word: DEBTISM;

VERSUS - - the prevailing role of traditional companies (the production, selling goods and services) DIA increase in

realized profit on invested capital (the meaning of running a business) by selling goods and services (CAPITALISM);

- characterised by a gap in valuation of achieved profit as book value (HISTORICAL COSTS) and its cash value, calculated from the point of view of cash flows,

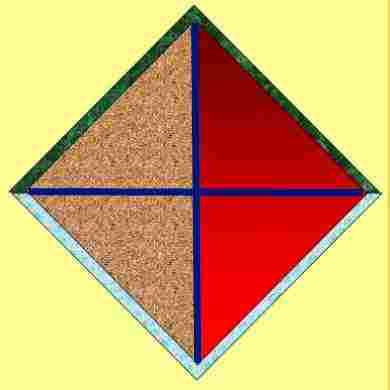

Parallelogram - A Barren Dialectical Upshot: Blind Alley

DIA

Parallelogram: Potentially a Fruitful Dialectical Upshot

DIA

Perhaps a New Opportunity?

the role of savings (in cash), although OF ESSENTIAL IMPORTANCE within such a kind of run economy, was neglected and substituted by the excessive role of DEBT, while the role of capital has been reduced to a kind of token for gaining access to this type of CASINO WAY OF DOING BUSINESS. In other words, seen from this kind of the long term perspective, sooner or later, it will be grasped that further borrowing (INDEBTING) due to the provision of a continuous tax-shield is the best way to run a profitable business, accordingly, a latent DIA cunningly imposed sale of the equity (own capital AND THE PROPERTY RIGHTS) to the hidden masters of this established natiocratic economic order. From the all previously said follows whether or not socialistic, capitalistic or feudal economics is run through classical or financial corporative way of organizing companies, private or state run companies, .... the problem of REGULARLY DIA SUCCESSFULLY closing the started business cycles by getting CASH in "hand" is a COMMON challenge (problem) to resume new business cycles (cash flows).

By applying as a foundation the postulate of finance that "the value of the share today is equal to the present value of (all of) paid out future dividends", in order to PREVENT the future harmful consequences of the economic crises and recessions for citizens (around the world), in the case, in a new established economic world order, the taxation was chosen, this DIFFERENCE between the present (true) VALUE of share and the PRICE of share on the financial market should be taxed, corrected by a tolerable rate of fluctuation. It should be also corrected in the case that a financial corporation increased the number of (permanently) employed workers (but not through acquisitions) compared to its PEAK year of employment, and obligatory during the grace ("standby") period of none-taxing of it for the entrepreneurship’s start-ups. In other words, the tax-relieves should be granted in each scenario in time DIA situation in space, when this is beneficial to ALL CITIZENS [of society and the established market network structure: MARKNET]. In either case, this approach is much less complicated, as well as risky for tax-payers, than the introduction of a kind of obligatory "car-insurance" [because they also will be compelled to pay for the insolvency of insurance companies in the case of crash of financial markets], for compensation of the made damages to the national states ... citizens (worldwide). In a similar way tax-bodies should deal with too high bonuses of the top management and board of directors as well. The (tax-)money, collected in such way should be invested in the promotion of new business venture ideas (entrepreneurship) to increase competition on this already NOT ENOUGH COMPETITIVE(ABLE) market, as well as for the DIRECT EMPLOYMENT of those (without job), who have been victims of the blows of raw market. Pay your attention, it MUST BE PREVENTED THE SPENDING this accumulated money in any kind of the UNPRODUCTIVE (social) sphere.

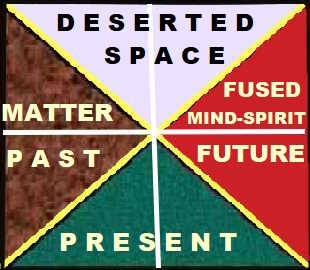

Bipolar DIA Binary Way of Thinking

(Recti)linear Creative Framework for the Orientation in Time AND Space

Ultimate Upshot of the Rectilinear and Traditional Dialectic Way of Thinking within the Rectilinear Space and Time: "PRESENT TIME", as An Ultimate Upshot of the Binary "OR - OR" Choice between the TWO Bipolar Dialects - Abandoned Hollow and Present Time

Concluding this dialectical interactive content under consideration, the major cause of troubles of the corporative way of organising was revealed, that is, the accumulation of the different values (financial speculative bubbles) over the passage of time DIA space between the price of share on financial market [CASINO PRICE of the token (chip) in this 'gambling'] and the PRESENT (TRUE) VALUE OF SHARE, calculated by the amount of all paid out dividends from the achieved profit until then. For this reason, this issue should also be supported by the addition of an ADDITIONAL and MANDATORY COLUMN in financial market reports for each financial corporation (individual way of thinking), which actually contains this information regarding the present (at that moment) value of its share, together with a data, how many years joint-stock company already has been listed on the financial market. Accordingly, the official index - points reported by financial markets also should be re-calculated on basis of the amount of all paid dividends until the current day, and this information MUST BE PUBLICLY available and REPORTED ON ALL (state’s, private ….) medias. The purpose of this is to be publicly displayed (exposed) the latent potential DIA probability of accumulation of speculative financial bubbles, by comparing these two kinds of calculated index – points, based on the "PRICE versus VALUE" of share of financial corporations on financial market (index – points: CROWD DIA group’s way of thinking).

Keep in mind, these kinds of payments (of dividends) are important, AT FIRST PLACE, as a kind of "control's dots" in time DIA space, that is, to check if CASH IS FLOWING, for example, in order to be paid out dividends (truly achieved profit), or not [generating cancerous trombs: Speculative financial bubbles]. Or more simply said, in this way the financial corporation cannot hide for ever the (accidentally) incurred cancerous (DIA further spreading) financial bubble, causing it to burst before they spread as metastases (globally) further [a more sustainable way of running economics]. In addition to this, the purpose of this is to reduce incentives for the speculative trading with shares, so the top-management has to find new ways how to provide the cash for paying out dividends, that is, focusing on core business activities instead of trading in (overvaluated) shares (sparkling). However, because it is only a part of this very complex dialectical interactive content, encompassed by the concept of debtors' DIA debt economics, it is not enough to be solved this challenge in time DIA space, but it touches into the core of it. Anyway, to be reduced the risk of next financial crunch, the previously emphasised difference in prices (the potential speculative financial bubble) has to be tackled in one or another way. Keep in mind,

- the problematic of the accumulated unpaid dividends to shareholders, including the part of it, swallowed in the labyrinth of global financial transactions on financial markets over time DIA space, that is, those that were never paid out, and which never will be,

- as well as the various forms of writing off (cuttings off) of the so-called bad debts by the established (INTER)NATIONAL financial institutions,

- pumping money into the financial markets by the so-called independent central banks,

- the misuse of the entrusted (free) financial resources (including SAVINGS of citizens as well) by the large number of finance market's actors DIA usurpation of them in a way as if it were own capital [although it is a very SMALL STAKE (part) of it], that is, the appropriation of entire amount of profit, which was achieved by investments of it [no any kind of distribution and returning (reimbursing) of the large part of this achieved gain to the true owners of these "free" financial resources], but not also are ready to pay the full price for the made losses (costs and damages), which are resuly of various speculative and manipulative activities. On the contrary, it was exploited as a new opportunity to further suck up available tax-payers' money, whereas the rest of it was transformed in the states' debts,

are also important aspects of the debtors' DIA debt's economics.

Read the Next Part: Debtism: an Offspring of the Neoliberalism and the Social Market Economy

© Copyrights 1996-2016, All Rights Reserved ®