Debtism - a New Established Natiocratic Economic Order

In this creative article, consideration and questioning of such hot topics, reflected through the prism of this newly introduced dialectical understanding of time and space, was not avoided, such as the role of (global) financial markets, SAFE harbours of the financial world of bonds issued by the states in a globalised world, long before the crash of financial markets (2008), when NOBODY ELSE DARED IN A SO PLAIN WAY, but simultaneously FOUNDED ON A SO SOLID METHODOLOGICAL background, to criticize this kind of ideological absolute dogmas, embodied within the latest established financial, economic and cultural order, which this creator of knowledge called the DEBTISM. In short, debtism is based on a financially business-oriented way of running the economy, initiated and further (globally) driven by continuous borrowing at all levels of organizing society (twisting debt spiral). In other words, this type of established economic and financial value system functions only with the help of further borrowing [indebting: increasing debts at the WORLD, STATE, group, collective, and individual level] through the interplay of various types of (short-term, medium-term, long-term, and life-long) taken, assumed loans, issued debts (of debtors dia repayment of creditors), which are then renewed and extended as necessary.

debtism versus classical capitalism

Within this latest established natiocratic economic and financial order, as a result of the change of both the main carrier and the main motivator for running the business as well as the driver of the economy:

- the leading role of financial corporations and (inter) national financial institutions;

- resale of shares (and the financial corporations as well) DIA the increasing its "value" by increasing the PRICE

of share in the financial market is the point of running a business, thereby paying not too much attention what are

the long-term consequences of this;

- ALSO pay attention to the fact that these financial transactions of the resale of existing shares take

place OUTSIDE the joint stock companies IN THE GLOBAL FINANCIAL MARKETS [which from the perspective of the

financial corporation represents "HISTORICAL CASH DIA INVESTED CAPITAL"]. In other words, these EXTERNAL

cash flows have no DIRECT connection with (INTERNAL) cash flows of joint-stock companies, within which

something is produced, sold, services performed, or some new knowledge is created;

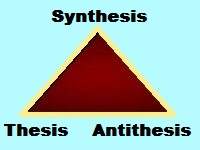

- in short, by using this developed methodological (DIALECTICAL) approach, there were unmasked DIA again

separated the ideologically interweaved (and then CROWDED) internal cash flows (THESIS), collected for the

newly issued shares (useful for the financial corporation), from the external cash flows (ANTITHESIS),

collected by its (TEMPORARY?) owners through the resale of existing shares [which is insignificant for cash

flows within the joint-stock company];

- remember, in accordance with the basic postulate of financial (cash) capitalism only these internal cash

flows determine the present (real) VALUE of the share calculated on basis of DIVIDENDS PAID from the

PROFIT ACHIEVED to its SHAREHOLDERS - OWNERS (SYNTHESIS DIA THE RENEWED THESIS), not these external

cash flows. In other words, only their (temporary) owners, investment banks, brokers and organizers of these

financial markets benefit from these external cash flows that take place on the global financial markets.

- Since these external cash flows represent the current temporary "value" of the share, that is, the changing

PRICE of the stock as determined by the financial market, this over time DIA (this global economic and financial)

space leads to the creation of a gap between these two contradictory divergent approaches to stock valuation

[share value versus share price: (Potential) Financial Speculative Bubbles], during the process of managing these

short-term and long-term goals;

- related to the above, since all the key actors of this way of organizing and conducting business are

(theoretically) replaceable over a (long) time DIA the corresponding covered (global) space, beginning from

owners (of shares) to the members of top-management and board of directors, it is to be expected that

short-term incentives and motives of this way of running business will be given preference, including

speculative and manipulative ways during the dialectical interplay of raising and lowering the share price,

the price of digital money, with the help of other instruments of financial engineering;

- In short, replacing the basic postulate of financial capitalism, "CASH IS KING", that is, CASH FLOWS

WITHIN the financial corporation, with an appropriate postulate of the debtor's DIA debt economy, "DEBT, IT

IS THE NEW KING FROM NOW", finally, a new economic, financial, and cultural natiocratic (societal) system

was established in the full sense of the word: DEBTISM;

VERSUS - the prevailing roles of traditional capitalist companies [producing goods and providing services] DIA

increasing realized profit on invested capital by selling these produced goods and realized services is the

meaning of running a business]: classical CAPITALISM;

- the main drawback of which is the financial gap that arose during the valuation of realized profits, expressed in terms of the time value of cash flows, that is, the difference between the accounting value of realized profits (HISTORICAL COSTS), and the CASH value of profits, calculated from the point of view of (input-output) cash flows of the company (Time is Money),

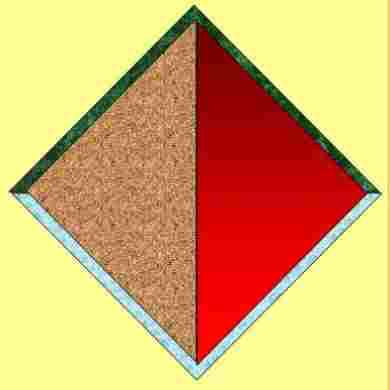

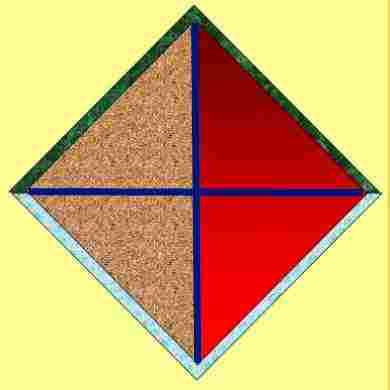

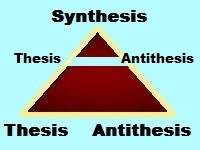

Parallelogram - A Barren Dialectical Upshot: Blind Alley

DIA

Parallelogram: Potentially a Fruitful Dialectical Upshot

DIA

Perhaps a New Opportunity?

the role of realized profit and savings (in cash), although OF ESSENTIAL IMPORTANCE within such a type of business management, was neglected and substituted by the excessive role of DEBT, while the role of capital is reduced to a kind of entrance VIP token for gaining access to this type of CASINO WAY OF DOING BUSINESS. In other words, seen from this long-term perspective of (heated) debtism, sooner or later, it will be grasped that further borrowing (INDEBTING) due to the provision of a continuous tax-shield is the best way to run a profitable business. In a further, deeper and broader sense and context of this way of (re-)organizing, managing and running business, it is about a kind of hidden sale of the equity (shareholder capital AND THE PROPERTY RIGHTS) to the hidden masters of this established natiocratic economic order. In this financial interplay between various types of debt including issued bonds (lord of debtism), cash (lord of financial capitalism), and profit (lord of classical capitalism) it is evident that debts have always represented a gray area as well as the most complex realm of financial business.

the interplay of equity and debtity: the gray side of debts

For example, while cash is necessary for the establishment of both a classic capitalist company and a joint-stock company, either in the form of invested own initial capital or by collecting financial resources from others through the issuance of new shares (equity), in the framework of the established debtism, their (hidden) restructuring, reorganizing, and transforming is, in fact, carried out, using various financial arrangements and appropriate financial instruments of financial engineering. The result of this way of restructuring the capitalist economy, as well as the capitalist way of making money and achieving financial profit (shareholder wealth) in general, is that in the accounting liabilities (of a joint stock company) the main role is played by various forms of manifesting debts and obligations to someone (debtity).

This is (sporadically and from time to time) leveled and aligned with the assets of the enterprise with the help of the (biased) visible hand of the state, and not with the invisible hand that drives the mechanism of the free market (Laissez-faire Capitalism), which in this decadent stage of the development of capitalism is intended to clean the market from poorly networked, positioned, and (strategically) insufficiently deeply structured "fishes and small fishes" into geo-political debt economy. In short, in spite of various accounting attempts to financially leverage the liabilities of a joint-stock company through the interplay of equity and debtity, the establishment of a financial coorporation, where the only founding capital, is debt is prevented or legally made infeasible, generally speaking. In other words, cash is needed because it is the essence of equity as well as the king of financial capitalism. Keep in mind, in the end someone will have to bear the consequences of bad business in whole or in part, while the taxpayers' money is in all natiocratic systems, the ultimate guarantor with the help of which the resulting economic, financial, social and political disorders and problems are solved.

In other words, for the purpose of buying shares, it is permissible to borrow money from external financial institutions, to borrow money from friends, relatives, and then invest it as founding capital, or for the purchase of (newly issued) shares or the entire company, if there is enough available and creatively accessable funds (using financial engineering). In short, it is not possible to borrow directly from investment banks, which are actually responsible for issuing and placing shares but for their purchase you need CASH. Pay attention to this manifestation and interpretation of the assumed risk by the shareholders in terms of the exchange of cash (for which something can be bought directly) for shares (for which something can only be bought indirectly), which also reflects the essence of financial capitalism ("Cash is King"). In addition, despite the possibility of forced collection of debts (if there is something to collect from), one should also take into account the other, gray side of debts or the parasitic side of debt, that is, the possibility that debts do not always have to be repaid (in full) while cash simply you don't have or you have it (regardless of how you got it).

All this complicates the monitoring of cash and debt flows on global financial markets, that is, obscures the possibility of getting a clearer insight into what is really happening on them, as well as within financial corporations themselves, especially if they have global business activities. In my opinion, international audit companies have the best insight into this because they are best positioned and structured in global financial, economic and business flows and developments in global markets. For this reason, special attention should be paid both to their business (and hidden) activities as well as to their potentially useful role in resolving previously exposed financial challenges and created problems (worldwide). Since within the framework of this last established natiocratically economic and financial order (debtism), index points (of the financial and economic elite) on the leading national and global financial markets grow much faster, not only than the (annual) growth of production and services provided but also faster than the realized national and (global) gross product, which includes a disproportionately small share of other layers of society, leads to further and further stratification of society into (extremely) rich and (very) poor, depending on who better adapts and "swims" in these murky waters and resulting toadstools of debtism, instead of how and how much (s)he contributes to the established social community with her, his work and knowledge. By the way, just imagine how it will be in the age of those who will rule Bioinformation and Biocommunication Technologies.

getting cash in "hand": a general, common, ever-present, and omnipresent challenge when running a business

It is important to note here that the measured and financially expressed wealth of these modernized financial capitalists, that is, their wealth expressed financially in terms of the shares owned, has always been relative, and this is especially so within the framework of debtism. In short, just as it is a long way from realized profits or earned dividends to cash in the "pockets" of (the majority) owners of a joint-stock company, both due to taxation and due to the purposeful avoidance of it by redirecting these financial activities to the resale of (existing) shares in global financial markets, the path from the share price on the financial market to the realization of this financial capitalist goal is even longer, because it is unpredictable how the (global) financial markets will react to it if it is about a sale of a considerable number of shares. For this reason, it is to be expected that in the mature stage of the development of debtism, the demand for additional "tax heaven" ways of solving this financial challenge, undertaking, and the corresponding operational intervention in search for the land of dreams, where much less or minimal taxes are paid, will grow.

From the all previously said follows whether or not socialist, capitalist or feudal economics is run, through classical or financial corporative way of organizing companies, private or state run companies, .... the problem of REGULARLY DIA SUCCESSFULLY closing the started business cycles by getting CASH in "hand" is a COMMON challenge (problem) to resume new business cycles (cash flows). Applying as a foundation the basic postulate of finance, "The value of a share today is equal to the present value of (all) future dividends paid", in order to PREVENT future harmful consequences of economic crises and recessions for citizens (worldwide), in the event that, in a newly established economic world order, taxation is chosen, this DIFFERENCE between the present (real) VALUE of the share and the PRICE of the share on the financial market should be taxed, corrected by the rate of fluctuation, which can be tolerated (similar to the desired or tolerated rate of inflation). It should be also corrected in the case that a financial corporation increased the number of (permanently) employed workers (but not by acquiring and taking over existing financial corporations but through new investments) compared to its PEAK year of employment, and obligatory during the grace period of non-taxation of newly formed start-up entrepreneurship.

In other words, the tax-relieves should be granted in each scenario in time DIA appropriate situation in space, when this is beneficial to MAJORITY OF CITIZENS [in established society and the established market network structure: MARKNET.] In either case, this approach is much less complicated, as well as risky for tax-payers, than the introduction of a kind of obligatory "car-insurance" [because they will also be forced to pay for the insolvency of insurance companies, in the event of a financial market crash], for the compensation of made damages to national states ... citizens (worldwide). In a similar way tax-bodies should deal with too high bonuses of the top management and board of directors as well. The tax collected in this way should be invested in the promotion of new business entrepreneurial ideas (entrepreneurship) in order to increase competition in this already INSUFFICIENTLY COMPETITIVE market, as well as for the DIRECT EMPLOYMENT of those (without job), who are always the real victims of the blows of raw market. Pay your attention, that the SPENDING of these accumulated funds in any kind of NON-PRODUCTIVE (social) sphere MUST BE PREVENTED.

the importance of paying dividends: the time value of money

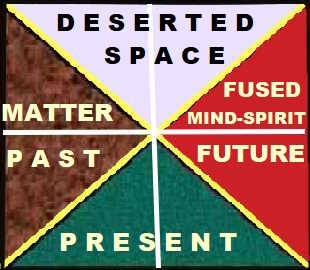

Bipolar DIA Binary Way of Thinking

(Recti)linear Creative Framework for the Orientation in Time AND Space

Ultimate Upshot of the Traditional Dialectical Way of Thinking within the Rectilinear Understanding of Space and Time: "THE PRESENT", as an Ultimate Upshot of the Binary "EITHER - OR" Choice between the TWO Bipolar Dialects - Deserted Space and the Present

Concluding this dialectical interactive content under consideration, the main cause of the troubles of the corporative way of organising was revealed, that is, accumulation over time DIA the encompassed space of different values (financial speculative bubbles) between the established price of the share on the financial market [CASINO PRICE of tokens in this type of 'gambling'] and the PRESENT (REAL) VALUE OF THE SHARE, calculated on basis of the amount of all dividends paid out of the profits achieved up to that moment. For this reason, this problematic issue should also be supported with the addition of an ADDITIONAL and MANDATORY COLUMN in financial market reports for each joint stock company (individual way of thinking), which actually contains this information regarding the present (at that moment) value of its share, including information on how many years the joint-stock company has been listed on the financial market. Accordingly, the official index - points reported by the financial markets should also be recalculated based on the amount of dividends paid up to the current day, and this information MUST BE PUBLICLY available and REPORTED ON ALL (state’s, private ….) medias. The purpose of this is to publicly expose the hidden potential expressed in terms of the probability of accumulated speculative financial bubbles, through a simple comparison of these two calculated index points, based on the dividend VALUE of the share versus the PRICE of the share of the joint stock company on the financial market.

If the created bubbles of accumulated debts are added to this, including also the realized value of used (but not repaid) debts of their previously explained gray side, which is even more non-transparent, inexplicable, and unfathomable, and whose direction of action and impact (of swirling debt spirals) is unpredictable, both in financial markets and in established (globalized) societies, especially when it acts in conjunction with the resulting financial speculative bubbles in the sense of their merging into ever-increasing debt spirals, a more complete picture of debtism is obtained. Keep in mind that the issued shares are also a kind of moral obligation (liabilities) or financial debt towards their (current) owners ("creditors"), that is, a type of "loan" obtained in the cheapest and most favorable market and business way. These assumed obligations still need to be repaid to them in the future, before this entrepreneurial venture begins to bring them profit (or losses) on their invested financial resources. In short, keep in mind that every manifestation of debt is ultimately a debt to someone, which in one way or another will be reflected both on individual, collective, and group, as well as on overall financial and business happenings in society, especially in this global and the globalized world, where everything is intertwined with economic, financial, business, cultural and political activities. For this reason, seen and considered from an individual point of view, any type of unpaid debt is in the domain of the shadow economy or the gray (parasitic) side of assumed and (fully) unpaid debt.

Summarizing everything that has been said above, dividend payments are very important, FIRST OF ALL, as a kind of 'control dots' in this dialectical understanding of time and space, the main feature of which is continuous changes in the (global) geopolitical, social, financial, and business environment. In other words, in this way is checked WHETHER CASH FLOWS through the financial channels of the joint-stock company or not, which is analogous to the flow of oxygen through the blood vessels of a living being [that the forming malignant thrombi can make more difficult or hinder: Speculative financial bubbles]. In short, cash [in the (current) account, as a proven way of controlling a successful business and the sovereign master of financial capitalism] is necessary to pay dividends from the actual realized profit, instead of the insufficiently transparent or barren presentation of the accounting realized profit of the joint-stock company. Let me remind you that this was the main drawback of calculating the realized profit of a company using the accounting methodology of classical capitalism, (where the cash value of the realized profit is estimated using historical costs).

Or more simply said, in this way the financial corporation cannot hide permanently the (accidentally) incurred cancerous (DIA further spreading) financial bubbles, causing it to burst before they spread as metastases (globally) further [a more sustainable way of running economics]. In addition to this, the purpose of this is to reduce incentives for the speculative trading with shares, so the top-management has to find new ways how to provide the cash for paying out dividends, that is, to put in focus core business activities instead of trading with already issued (old) shares (flashing). However, because it is only a part of this very complex dialectical interactive content, encompassed by the concept of debtors' DIA debt economics, this is not enough to be solved this challenge in time DIA space, but it touches into the core of it.

It is especially unacceptable that, despite many years of profitable operation of a joint-stock company, its present value of the stock is zero or insignificant and negligible compared to the price of its share on the financial market. This should be resolved by legislation supported by appropriate fiscal incentives. For this reason, one should distinguish joint-stock companies that pay dividends to their owners from realized profits (which is much more similar to the way of doing business in classical capitalism) from joint-stock companies that do not pay dividends to their owners, but make profits by trading already issued shares (with additional risk, which is far more similar to the way of conducting business in debt "capitalism"). Also, pay attention to how the role of profit of classic capitalism is bypassed in this way, so the question arises, whether after this quiet "revolution" this is really about capitalism. In any case, the (socially moral) derogation and decline in value of (classical) capitalism is the result of this approach to running a business (decadent debt capitalism).

- Seen from the perspective of the dialectical understanding of time and space, this is another form of hidden exploitation or natiocratic abuse of the term future in the sense that it is necessary to wait for (distant and) better "future" days to enjoy the fruits acquired in the past and present.

- Keep in mind that this is the basic premise and assumption of the natiocratic (black and white) understanding of the concept of solidarity in terms of its proper application versus its abuse during the flow of this linear understanding of time and space. To cut this long story short, in any (natiocratic) society where evil prevails (over good) and the mob dia group way of thinking and mindset (instead of an individual mindset), in that proportion will be favored the detours and evil ways of this simple black or white choice. In other words, seen from the perspective of the dialectical interactive approach, this promised future will not only be abused but will continue to be abused.

- Regarding the dialectical interactive content that is being considered creatively, regardless of all that was previously said in terms of emphasizing the importance of distinguishing Good (right) from evil (wrong), according to them, the past and the present should always be sacrificed in the name and benefit of this promised (distant) future, although this is even in complete contradiction to the main premise of financial capitalism that "a dollar today is worth more than a dollar tomorrow" (the time value of money).

- All the more, because the present value of the share is calculated precisely using this time value of money by applying the compound interest rate (interest earned on interest), which is based on this time value of money (Time is Money). Or to put it another way, companies and other social and technological products, similar to the lifespan of living beings, also have a limited lifespan.

- As an example, look at the list of the 500 largest and most profitable companies 50 or 70 years ago. Did they manage to pay all future dividends from realized multi-year profits (and inevitable financial losses, as a result of economic crises, recessions, and inappropriate management of the company, which was not continuously adapted to the demands of the future)?

- Concluding this dialectical interactive content related to the time value of money, everyone, including shareholders, wants to get cash in their hands from the realized profits, if not next year, then in 4,5,6... years, that is, as soon as possible. It follows from this that the non-payment of dividends from realized profits, from time to time, represents the gray side of this way of conducting business. Seen from the methodological point of view of the dialectical interactive approach, pay attention to how by the redefinition of this basic methodological setting related to the time value of money, debtism (which was still in its infancy) arises by undermining the essence and core of financial capitalism.

- Notice also how in every manifestation of natiocratism, one adopted or imposed rule applies when it comes to the interests of the natiocratic elite, while the same ideologically propagated rule is applied in a completely different way for the other lower layers of society, in a hierarchically organized natiocratic pyramid.

In any case, in order to reduce the risk of financial market collapse, the previously highlighted difference between the current value of the shares and the price of the share (a potential financial speculative bubble or the resulting financial foam) should be tackled in one way or another, because it is far simpler to solve compared to creative challenges of solving and untangling the extremely intricate tangle of intertwined manipulative bubbles of accumulated debts. Keep in mind,

- the problematic of the accumulated unpaid dividends to shareholders, including the part of it, swallowed in the labyrinth of global financial transactions on financial markets over time DIA space, that is, those that were never paid out, and which never will be,

- as well as various forms of writing off so-called "bad" debts by established (INTER)NATIONAL financial institutions,

- pumping money into the financial markets by the so-called independent central banks,

- the misuse of the entrusted (free) financial resources (including SAVINGS of citizens as well) by the large number of finance market's actors in the sense of usurping these free financial resources as if it were one's own capital [although it is a very SMALL SHARE of it]. In other words, the largest part of the profit, which was realized by investing these free (and very cheap) financial resources, is appropriated. As a result, there is no suitable distribution and return of a huge part of this realized profit to the real owners of these "free" financial assets, but not ready to pay the full price for the incurred losses (costs and damages) through various speculative and manipulative activities.

- On the contrary, this is exploited as a new opportunity to further drain the available money of taxpayers, while the rest of these outstanding obligations are converted into government debts or by granting them cheap (or sometimes interest-free) loans. Pay attention that these cheap (or interest-free) loans are not given to over-indebted small businesses and small entrepreneurs, because they are not sufficiently networked and structured in this established financially economic system (of values), not to mention the millions of over-indebted citizens: A form of subjugation and serfdom by applying this well-established natiocratic mechanism of the debtor's economy dia (continual accumulation) of debts;

are also important aspects of the debtors' DIA debt's economics. Despite all of the above, there is no doubt that classical capitalism and financial capitalism (except in its last phase of development) best directed and used these free financial resources compared to other natiocratically oriented economic and financial systems of running economics and business. This primarily refers to their use for entrepreneurial purposes, both at the micro level and at the macro level of undertaken and implemented small and (very) large investment ventures.

Regardless of all of the above, this creative article focuses on the gray sides and parasitic properties of debtism, which actually corrode it from the inside. As it was previously elaborated, the use of available free financial resources was not spared from this gray side of natiocratism. If to this is added that the bank and, in the last case, the state (with taxpayers' money) guarantee the return of only part of the depositor's money given to the banking financial institutions for "keeping" to dispose of this "capital" taking into account primarily the interests of the owners of these financial institutions, an even more complete picture of the real events on the financial market of money is obtained.

epilogue

Although it seems without a deeper insight into the economic and financial essence of the natiocratic order of debtism that this indebted way of running the economy and business is encouraged and fed with cheap money through the low-interest rates of central banks, it could also be contradicted in the sense that in this way, the hot cauldron of this newly established economy of debts and debtors is also cooled. This is supported by the attempts and efforts of banking institutions to introduce negative interest rates on "free" financial resources (savings) in conjunction with excessive printing of various types of money (to reheat this cooled cauldron?), which leads to high inflation. Notice how this gray side of "free and increased" financial resources turns into its dark side by devaluing money, that is, an even deeper invasion into pockets of savers and consumers, because real money must be found somewhere to fill the resulting financial, economic, and social holes and voids.

- Even though all of the aforementioned took place in other natiocratic economic and financial systems, including classical and financial capitalism, there is still one important difference. In short, it is one thing to run a household, business, or economy in an abundance of free financial resources, or to have (at least) some financial reserve for "dark days", while it is quite another to run a household, business or economy in conditions of a tight budget or an insufficient budget for the achievement of desired goals.

- And this is precisely the weakness and drawback of debtism (Debt is King), which makes it even more difficult to solve the problems caused and the resulting consequences of this debt-based way of running the economy and business.

Keep in mind that maintaining low (and negative) interest rates (cheap money) is contrary to the usual way to solve problems and creative challenges caused by high inflation because high inflation is usually countered by increasing the interest rate of the central bank (expensive Money). This interplay of cheap and expensive money can be expressed in another way: While inflation is a hidden form of additional taxation of citizens and business entities (as a substitute for an unpopular visible increase in tax rates), low-interest rates (which are lower than the inflation rate), and especially negative interest rates on free financial resources, are a hidden form of additional getting into the pockets of depositors through this "debt-forced" increase of available "free" financial resources (a kind of racketeering payment to this type of protector and guardian of the acquired treasure).

Or expressed in another way, the motive and meaning of saving is undermined in this way and thereby the economy of debts and debtors is additionally being encouraged, despite the fact a (variable) compound interest rate is always charged on issued debts. In other words, when a household or business is run in the conditions of debtism, thou are always more or less on the losing side, unless you are part of the privileged strata of society. Summarizing the above, the debt economy DIA the established economy of debtors is additionally cocooned and muddied by the natiocratic tangle of financial transactions and established social and economic relations within it. In any case, the price that must be paid for this interplay of high- and low-interest rates in interaction with the resulting speculative financial and manipulative debt bubbles is that all this causes regular economic stagnation and recession, as well as increased inflation, while in the dialectically long term, this leads towards the world economic crisis.

The Natiocratic Pyramid

It also follows from this that the established financial, fiscal, and economic institutions are deeply rooted in the natiocratic way of organizing society, and for this reason, it is difficult to change their inherited natiocratic core and essence. In other words, it is very difficult to adapt them to the individual way of thinking and mindset, in this particular case to the individual needs and demands of all, or the (vast) majority of citizens, because that touches into the very core of natiocracy, generally speaking. As highlighted in the previous creative article, every manifestation of natiocratism seeks or requires the sacrifice of the interests of (ordinary) citizens in favor of the narrow-minded interests of the (ruling) natiocratic elite (depending on where or how one is positioned on the social ladder of the established natiocratic pyramid). It also follows that the ideological aspects and properties of debt, cash, profit, and capital also have a deep root in natiocratism, and that it has played a very important role in all previous natiocratic social orders with continuous inheritance, transmission, and modernization of the very core and essence of natiocratism.

Of course, it is assumed here that these ideological aspects and properties of debt, cash, profit, and capital played their role in various degrees of influence and supremacy, including the use of some other ideologically colored term, but without changing their essence in the newly established political, economic, financial and cultural-religious (value) system of natiocratism. For example, although invested capital in the purpose of making a profit played the main role in classical capitalism, that is, profit was the main instigator and motivator of this capitalist way of conducting business, this does not mean that the shareholder way of doing business, as well as various types of lending, were not present in classical capitalism. The same applies to financial capitalism and debtism (debt "capitalism"), with the difference that their main instigators, motivators, and masters have been changed. In other words, what is at the heart of their business, that is, what everything revolves around, has changed.

It is also noticeable that even at the macro-level of running the economy, the mode in which debts are managed (for example, issued bonds), that is, for what purpose it is used (for entrepreneurial, productive, non-productive, barren purposes... for general social benefit, for preserving the interests of the natiocratic elite, for the social sphere, etc.) is insufficiently transparent and ideologically politically colored.

- For example, the realized profits and funds collected through the sale of shares in conjunction with issued government bonds and bank loans were the wings and carriers of the Industrial Revolution (that is, the era of classical capitalism). Almost all of these water canals, the railway network, and much else that is seen throughout Western Europe, and which decorates it as well as makes it what it was and what it still is due to this inherited wealth, originates from this period.

- By applying similar concessions, Roosevelt's "New Deal" created the necessary infrastructure for the post-war rise of the USA, and not only solved the pressing financial, economic, business, and social problems caused by the Great World Economic Crisis.

And how did these modern economic and financial "strategists and experts" solve pressing problems during the crash of the financial markets (2008) despite the considerable progress achieved in the field of (information and telecommunication) technology and scientific thought, generally speaking? Quite the opposite, not taking into account general social interests at all, but primarily how to protect the interests of the natiocratic elite (as well as other privileged layers of society). Debt trading on global financial markets as a new type of issued debt "securities" is a special story and achievement of financial engineering, which in fact reflects the financial and economic essence of the debt-based way of conducting business within this newly-established natiocratic social order.

- How else to explain that the human minds of that time with that level of development of (information and telecommunication) technology managed to set foot on the soil of the moon, and encouraged by this they predicted the establishment of human settlements not only on the seas and oceans but also on the Moon and Mars, as well as space tourism available to ordinary citizens. And all that in the next fifty years. Do you see any of those (very) optimistic predictions and forecasts coming to fruition?

- Moreover, these modern digitized brains half a century later are unable to safely land these unmanned robotic "metal boxes" on the lunar soil. And who normal would put his life at risk, thereby handing over their fate in the hands of these modern over-digitalized brains?

- But this is already entering the domain of domination of various types of (deeply) vulgarized minds, as a result of both the negative selection of the necessary personnel and the excessive reliance on digital brains, which have taken over and now firmly hold all the strings in their hands, or with various types of digitized paws.

- It follows from this that in every natiocratic social system, the main role is played by moral-ideological suitability, loyalty, and protection of the interests and privileges of the natiocratic elite, as well as various manifestations of connections and ties to get an appropriate education, job, or anything else. This is the value system and the motto of every natiocratic social, political, economic, and cultural-religious societal order established so far. Only the method used to silence unruly rebels varies.

It follows from all this that debtism is a form of negation and annulment of the achieved results of classical capitalism. Even in the last phase of the development of financial capitalism ("Cash is king"), while debtism gradually took over the primacy, which is (still) wrongly called neoliberalism, the gradual withering away of economic entities based on classical capitalism could be clearly observed. First of all, this refers to small businesses, and especially to the rapid demise of small family businesses. In this first stage of debtism development, this trend is accelerating even more, so it is not difficult to predict their fate in the future, despite their enormous and superhuman 24x7 efforts to stay afloat in this ruthless business environment of debtism. Finally, it is important to note that debtism ("Debt is King") infiltrated certain countries and regions even in the age of neoliberalism, and even earlier, that is, during the gradual assumption of primacy over financial capitalism ("Cash is King"). In short, summarizing everything previously said, debtism leads to a barren and impotent natiocratic social system (of cultivated values) in the dialectical long term.